How to Finance Your Tiny Home Project: Tips and Resources

Share

Introduction

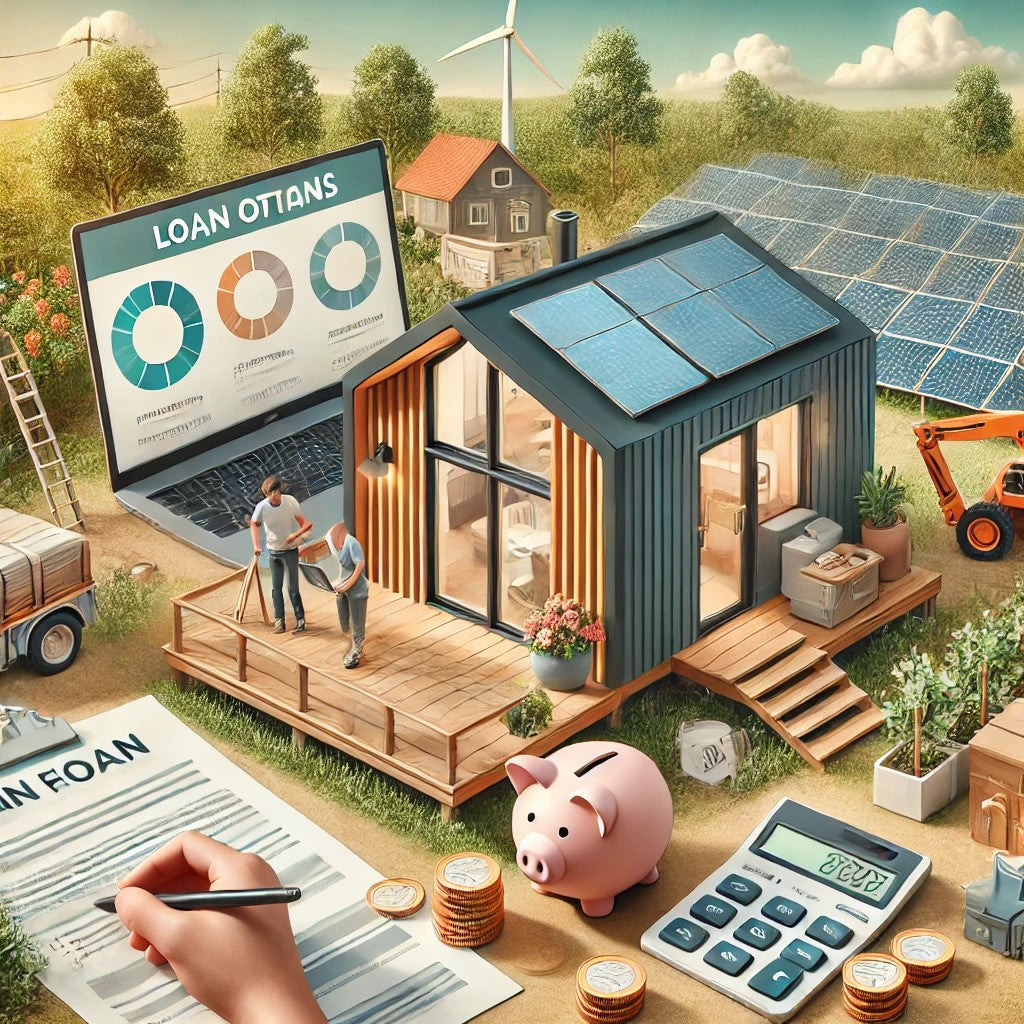

Embarking on a tiny home journey can be both exciting and financially daunting. While the appeal of downsizing and embracing a simpler lifestyle is undeniable, figuring out how to fund your tiny home project is a crucial step. From loans and savings strategies to creative financing options, understanding your financial roadmap is key to turning your dream into reality. For a deeper understanding of the costs involved, resources like Cost Breakdown: Building a Tiny Home vs. Buying a Tiny Home can provide invaluable insights.

When it comes to securing funding, there are various avenues to explore. To better navigate your options, How to finance a tiny home offers practical advice on loans, budgeting, and alternative funding methods tailored to tiny living. Let’s delve into the best tips and resources for financing your tiny home project.

1. Exploring Traditional and Alternative Loans

Personal Loans

One of the most common ways to finance a tiny home is through personal loans. Unlike traditional mortgages, personal loans do not require the property to meet specific housing standards, making them a flexible option for tiny home enthusiasts. These loans typically have shorter repayment terms, ranging from two to seven years, and fixed interest rates.

However, because personal loans are unsecured, the interest rates can be higher than secured loans. It’s essential to shop around and compare offers from different lenders to find the best terms. Online lenders, credit unions, and banks are excellent places to start.

RV Loans

If your tiny home is on wheels and classified as a recreational vehicle (RV), you may qualify for an RV loan. These loans often come with lower interest rates than personal loans because the home serves as collateral. To qualify, your tiny home must meet specific RVIA (Recreational Vehicle Industry Association) standards, so be sure to verify compliance during the build process.

Home Equity Loans or HELOCs

For those who already own a traditional home, tapping into home equity can be an effective way to finance a tiny home project. Home Equity Loans provide a lump sum at a fixed interest rate, while Home Equity Lines of Credit (HELOCs) function more like credit cards with variable rates. Both options offer lower interest rates compared to personal loans, but they do require you to put your existing property on the line.

Tiny Home-Specific Lenders

As the tiny home movement grows, specialized lenders are emerging to meet the unique needs of tiny homebuyers. These lenders often understand the challenges of financing non-traditional homes and may offer tailored solutions, such as lower down payments or longer repayment terms.

2. Budgeting and Saving for Your Tiny Home

Assess Your Financial Goals

Before diving into financing options, it’s crucial to determine how much you can afford to spend on your tiny home. Start by assessing your current income, expenses, and savings. Consider creating a detailed budget that accounts for both the upfront costs of building or purchasing a tiny home and ongoing expenses like utilities, maintenance, and insurance.

Down Payments and Savings Plans

Most financing options require a down payment, which typically ranges from 10% to 20% of the total cost. Building a savings plan to meet this goal is a great way to minimize the amount you need to borrow. Automating your savings through a dedicated account can make this process easier and more consistent.

Additionally, cutting back on discretionary spending, selling unused items, or taking on a side hustle can help accelerate your savings timeline. Remember, every dollar saved upfront reduces the amount you’ll need to repay with interest.

Cost-Effective Building Strategies

If you’re building your tiny home from scratch, consider cost-effective strategies to reduce your expenses. Buying materials in bulk, sourcing reclaimed items, and tackling some DIY projects can significantly lower your overall costs. Working with experienced builders who specialize in tiny homes can also help you stay on budget while ensuring quality construction.

3. Creative and Alternative Financing Options

Crowdfunding and Community Support

Crowdfunding platforms like GoFundMe or Kickstarter have become popular avenues for financing unique projects, including tiny homes. By sharing your story and vision, you may be able to garner support from friends, family, and even strangers who resonate with your goals. Offering incentives, such as naming rights for certain parts of your home, can make your campaign more engaging.

Community support can also come in the form of local grants or housing programs. Some municipalities offer incentives for eco-friendly or alternative housing projects, so be sure to research options in your area.

Rent-to-Own Agreements

If you’re purchasing a pre-built tiny home, some builders and sellers offer rent-to-own agreements. These arrangements allow you to make monthly payments toward eventual ownership, similar to a lease-to-own model. While this option may involve higher upfront costs or interest rates, it’s a viable solution for those who may not qualify for traditional loans.

Peer-to-Peer Lending

Peer-to-peer (P2P) lending platforms connect borrowers directly with individual lenders, bypassing traditional financial institutions. Platforms like LendingClub or Prosper often offer competitive rates and flexible terms, making them an attractive option for tiny home financing. However, it’s important to carefully review the terms and ensure you can meet the repayment schedule.

Bartering and Skill Swapping

In the spirit of minimalism and community, some tiny homeowners have financed their projects through bartering or skill swapping. For example, offering your skills in carpentry, design, or marketing in exchange for materials or labor can significantly reduce your out-of-pocket expenses. This approach not only saves money but also fosters a sense of collaboration and connection within the tiny home community.

Conclusion

Financing a tiny home project may seem challenging at first, but with the right strategies and resources, it’s entirely achievable. Whether you choose traditional loans, build a robust savings plan, or explore creative alternatives like crowdfunding, the key is to align your financing approach with your financial goals and lifestyle.

As you embark on your tiny home journey, remember that every step brings you closer to a more intentional, sustainable, and fulfilling way of living.